Week 4 Principles of Economics Microeconomics

The price system

Free markets are governed by the invisible hand of pricing. Free markets consist of very large number of strangers who need to collaborate with each other for their own self interest. How do these large number of stranger collaborate?

Price is a signal wrapped up as an incentive.

- In a free market with lots of participants, everyone wields a small influence.

- A consumer can decide to buy or not buy a particular good at a given market price.

- This effectively means that the consumer values the good less than the market price.

- This is a signal to the suppliers to find cheaper ways to produce the same good, driving the price down.

- This gives everyone a little bit of influence on price.

World market is not a story of competition, but it is a story of collaboration.

The great economic problem

All markets are linked together.

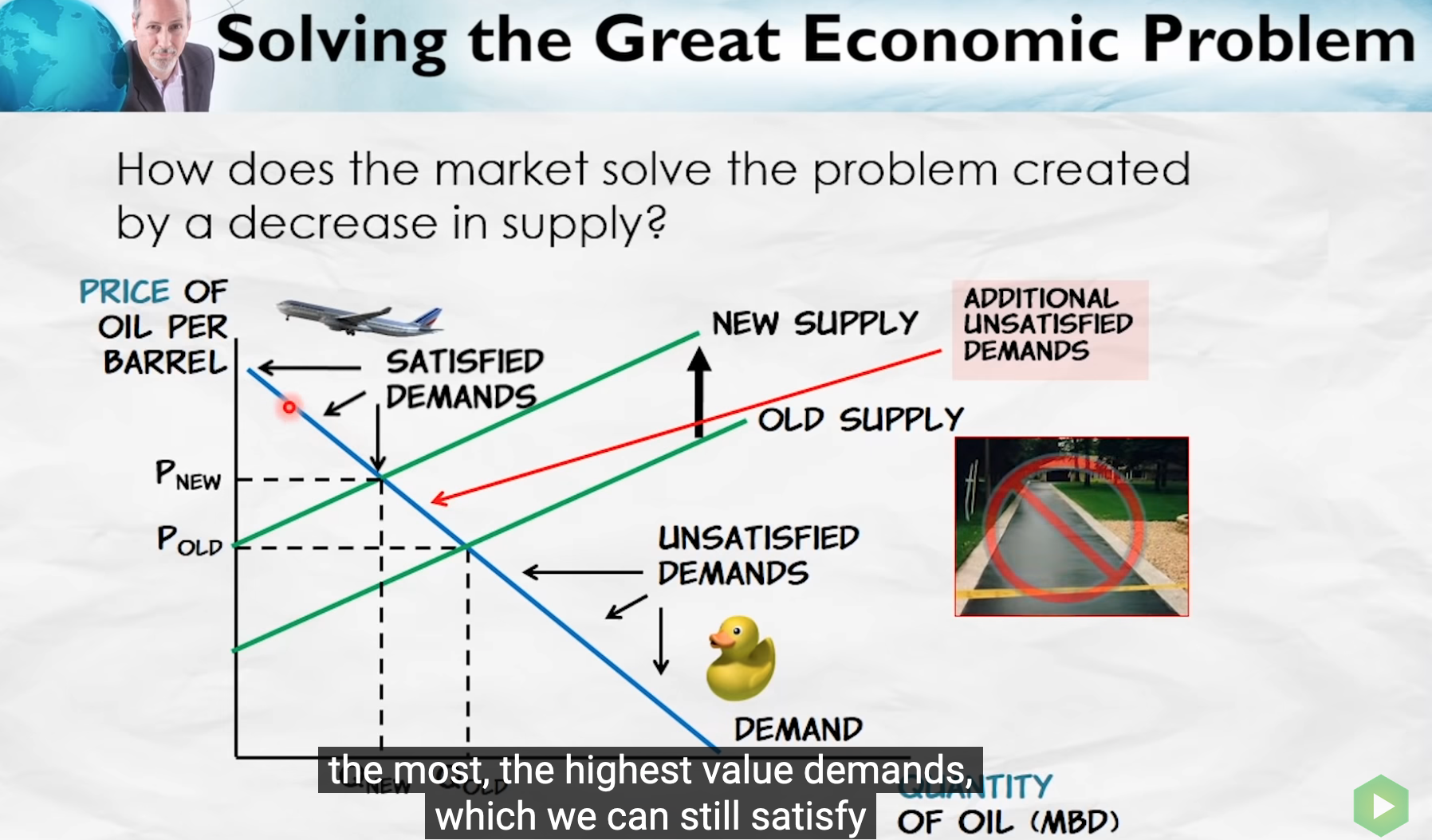

The great economic problem is - How to arrange our limited resources to satisfy as many of our wants as possible?

How to allocate resources?

- Central Planning

- Tried in communist countries.

- Resources are allocated by a central figure.

- Problems with this approach is there is too much information to be digested by single person or committee.

- Markets are too interlinked so it is hard to know 2nd order effects.

- There are too few incentives to allocated resources to maximize the outcome.

- The pricing system

Information & Incentives

How does the price system solve the great economic problem?

Price = Marginal value.

= Lowest value satisfied demand.

= Highest value unsatisfied demand.

= Social opportunity cost.

Information problem

- The market captures all information in a single value - the price.

- If you value a good more than the price, you buy.

- If you value good less than the price, you find substitutes which are cheaper.

- Every single consumer makes these decisions every time they participate in trade.

- These decisions about value and price are not based on some global knowledge, it is based on their own localised knowledge.

- This incentivises consumers to respond to price changes.

- Similarly a supplier will also respond to price changes to find cheaper ways to produce a good to meet unsatisfied demand.

Summary

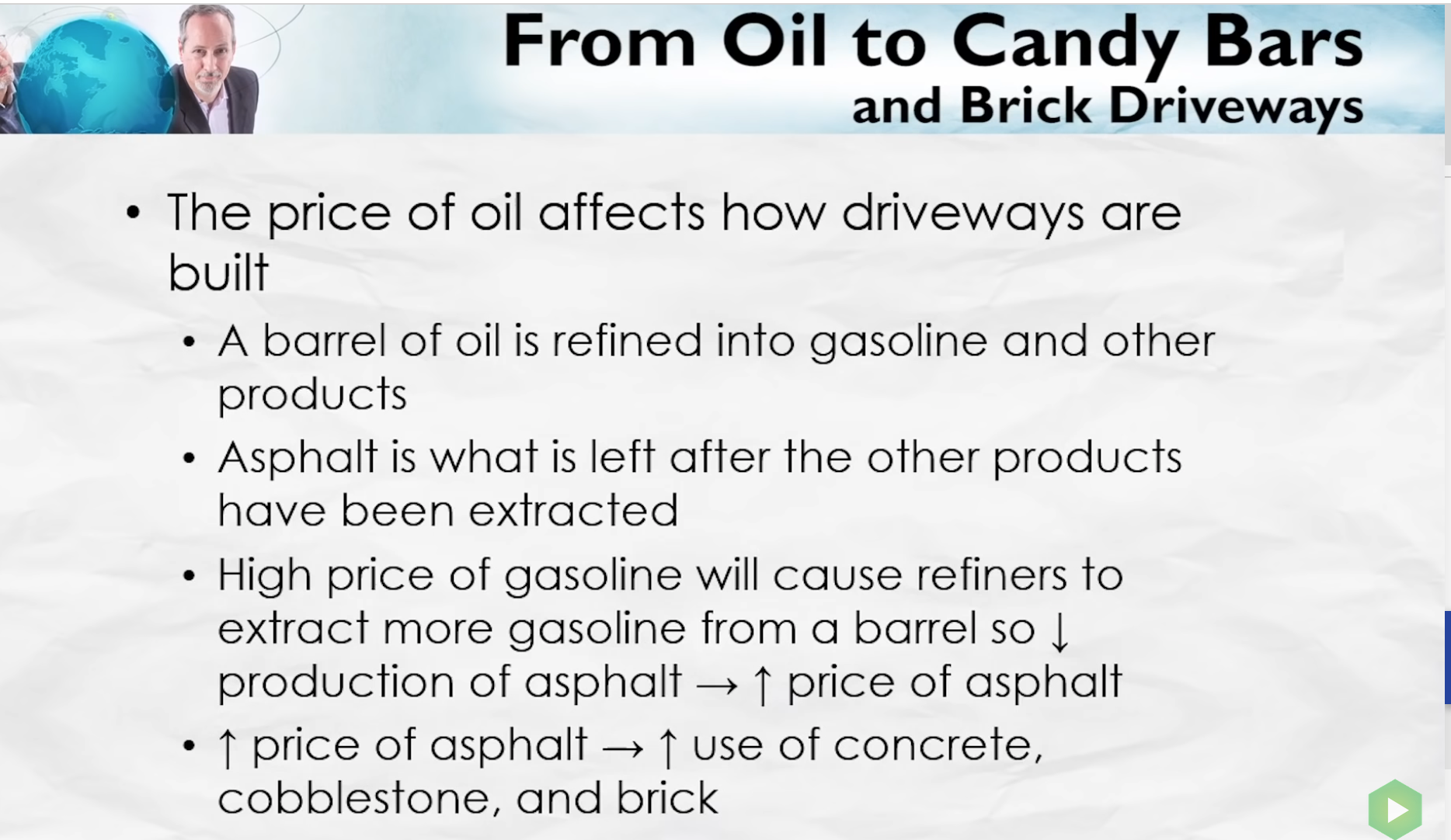

Markets are interlinked in many different ways

- Geographically.

- Via substitutes and complement goods.

- Markets are linked via time, current action affects future supply and demand.

Market is like a giant computer. It is continuously evaluating price based on signals from trades

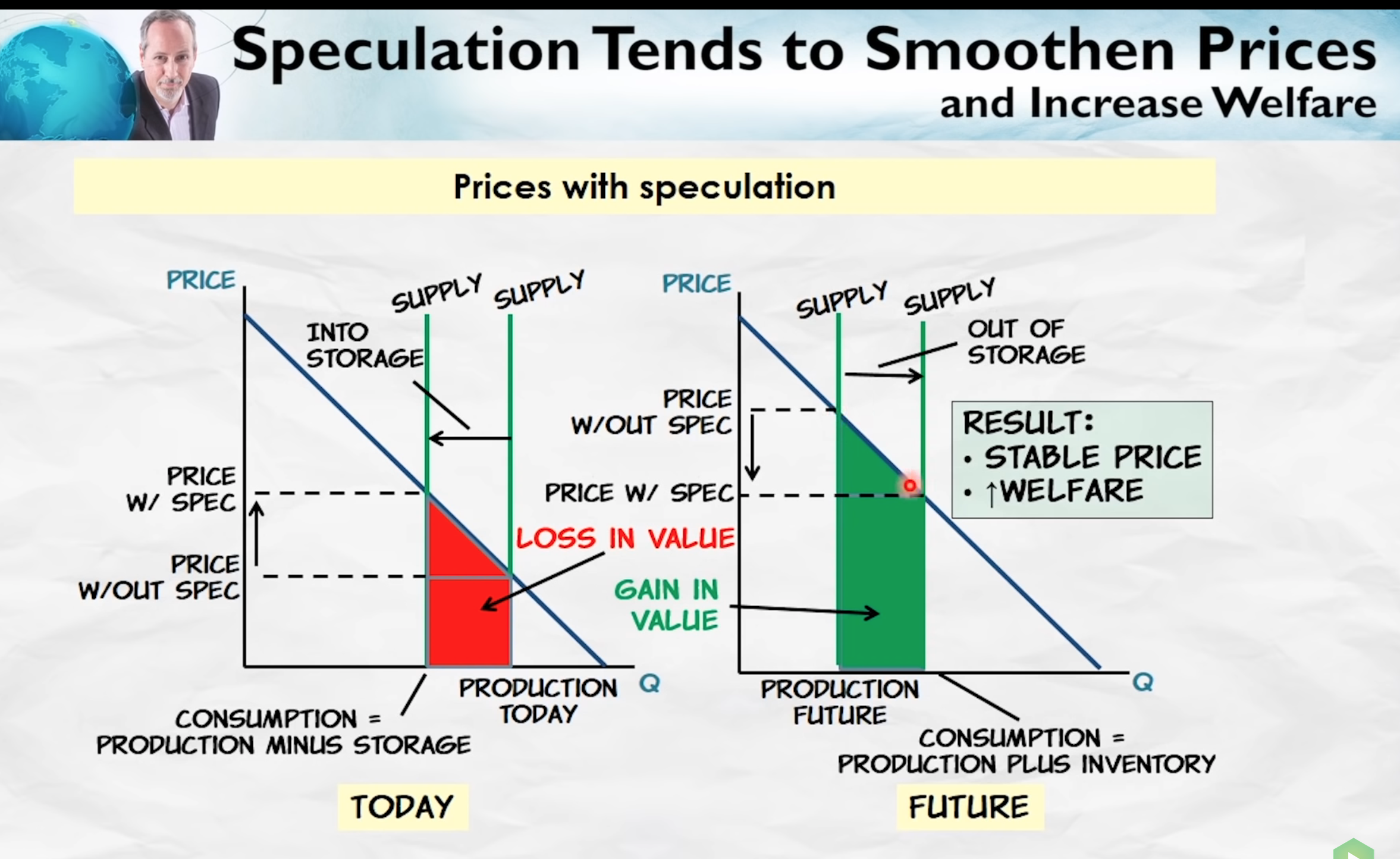

Speculation

Speculation is using your knowledge and information to predict supply and demand in the future.

Speculators are moving resources through time.

If there is a resource shortage in one geography, it creates an opportunity to buy at surplus geography and then sell at geographies with shortages. Speculators do this through time. They predict whether price will rise or fall in the future. Based on that they decide to either sell now or sell in the future. Hence profiting from their predictions.

Effect of Speculation

Speculations keep prices stable over long term.

Prediction markets

- Prices are signals that contain information.

- It informs how much a person values that good.

- It also informs that a person may have some specific knowledge about future.

- Speculators are conveying their info by participating in futures market.

Prediction market - A speculative market designed so that prices can be interpreted as probabilities and used to make predictions.

Is speculation a global good?

(This is not from the lectures.)

Often speculators get a bad name as it closely resembles gambling. However speculation is different and helps the world in general.

Speculators, by participating in futures markets such commodity market, help keep prices more stable. When current prices are low, but future prices may be high, speculators are incentivised to buy now and sell when prices rise. By selling in future, they are essentially increasing supply in the future. This reduces the price in future, bringing more buyers and essentially maximizing producer and consumer surplus.