Week 3 Principles of Economics Microeconomics

Tax and subsidy

Commodity taxes

- It is a tax on good.

- Who pays the tax does not depend on who writes the check.

- Who pays the tax does depend on relative elasticities of demand and supply.

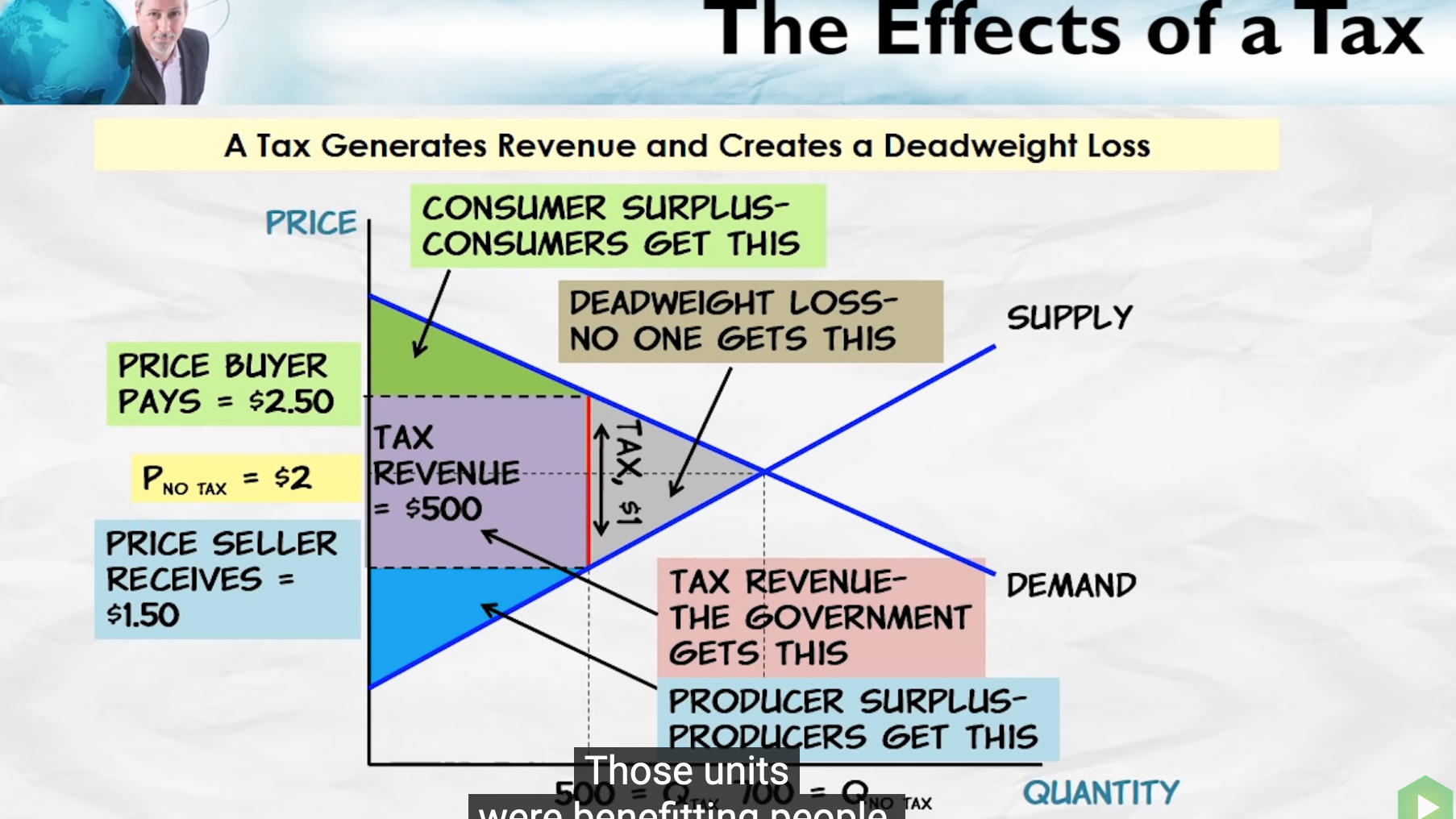

- Commodity taxation raises revenue and creates lost gains from trade known as dead-weight loss.

Who pays commodity tax?

The more elastic side of the market will pay a smaller share of a tax.

- Elastic demand means more substitutes available, so consumers can escape paying the tax by buying non-taxed substitutes.

- Elastic supply means that the resources used to product the taxed good can easily be moved to other industries so they can escape the tax.

- Tax burden is determined by relative elasticity.

Explanation - when a demand curve is highly elastic tax, essentially a price increase, means quantity demanded falls by a lot. If the supply curve is highly elastic, it means number of trades being made reduces significantly. If supply curve however is very inelastic, it means suppliers need to make trades happen and not allow quantity demanded to fall a lot. This effectively forces them to absorb the tax burden. If both curves have same elasticity, then tax burden will be split 50-50.

Deadweight loss

Deadweight loss is the value of trades not made due to tax. Deadweight losses are larger the more elastic the demand curve.

Subsidies

- Subsidies are effectively negative taxes.

- Who gets subsidy does not depend on who receive the check.

- Who benefits depends on relative elasticities of demand and supply.

- They are paid by taxpayers and they create inefficient increases in trade known as dead-weight loss.

Wage subsidy

- Minimum wage has similar effect on supply and demand of labour as that of a tax. It reduces supply of jobs.

- Wage subsidy on the other hand increases demand for labour.

Explanation - Based on observe effects it can be argued that supply of low cost labour is inelastic, where as demand is more elastic. Low cost labour due to skills gap does not have many choices available. Whereas low paying jobs can be automated using technology, so demand is more elastic. This effectively means that raising minimum wage, equivalent to a tax, affects supply side more adversely and hence is not in favour of workers.